All Categories

Featured

IMPORTANT: You should NOT repay the overdue tax equilibrium during your purchase procedure (you will certainly probably need to accept a Quit Claim Deed rather than a Service warranty Action for the residential property). Play the waiting game until the property has been confiscated by the area and marketed and the tax sale.

Going after excess earnings offers some pros and disadvantages as an organization. Think about these before you add this strategy to your real estate spending repertoire.

There is the possibility that you will certainly gain absolutely nothing in the end. You might lose not only your money (which with any luck won't be significantly), yet you'll likewise shed your time too (which, in my mind, is worth a lot extra). Waiting to collect on tax sale excess needs a great deal of resting, waiting, and hoping for results that typically have a 50/50 opportunity (typically) of panning out positively.

Accumulating excess profits isn't something you can do in all 50 states. If you've currently obtained a residential property that you wish to "roll the dice" on with this technique, you 'd better wish it's not in the wrong component of the country. I'll be honestI have not spent a great deal of time dabbling in this area of investing since I can not handle the mind-numbingly slow speed and the complete lack of control over the process.

In addition, most states have legislations impacting bids that go beyond the opening bid. Settlements above the county's benchmark are understood as tax sale overages and can be successful financial investments. The details on overages can produce problems if you aren't aware of them.

In this write-up we tell you exactly how to obtain checklists of tax obligation excess and make cash on these possessions. Tax sale overages, likewise referred to as excess funds or exceptional bids, are the quantities bid over the starting rate at a tax public auction. The term refers to the bucks the capitalist invests when bidding process above the opening bid.

This starting number mirrors the taxes, fees, and rate of interest due. The bidding begins, and several investors drive up the price. You win with a bid of $50,000. Therefore, the $40,000 increase over the original bid is the tax obligation sale excess. Asserting tax sale excess means acquiring the excess cash paid during an auction.

That stated, tax obligation sale overage insurance claims have shared attributes across many states. overbid tax deed proceeds. Normally, the area holds the money for a specified duration depending on the state. During this period, previous owners and home loan owners can speak to the area and receive the overage. Regions generally do not track down previous owners for this objective.

If the duration runs out before any interested parties claim the tax obligation sale overage, the county or state generally soaks up the funds. Once the cash mosts likely to the government, the opportunity of claiming it disappears. Consequently, past proprietors get on a rigorous timeline to claim excess on their buildings. While excess usually don't equate to greater incomes, financiers can benefit from them in a number of methods.

Tax Overage Business

, you'll gain interest on your whole bid. While this facet doesn't suggest you can declare the excess, it does help reduce your expenditures when you bid high.

Keep in mind, it might not be lawful in your state, indicating you're restricted to collecting rate of interest on the overage. As mentioned over, a capitalist can find means to make money from tax obligation sale excess. Since rate of interest earnings can put on your entire quote and past owners can assert excess, you can leverage your understanding and tools in these circumstances to optimize returns.

Initially, similar to any type of financial investment, study is the critical opening step. Your due diligence will certainly provide the essential understanding into the residential or commercial properties offered at the next auction. Whether you utilize Tax obligation Sale Resources for investment information or contact your county for information, a thorough assessment of each residential or commercial property lets you see which properties fit your investment design. A critical aspect to bear in mind with tax sale excess is that in the majority of states, you only need to pay the area 20% of your total bid in advance. Some states, such as Maryland, have laws that go past this guideline, so once again, research your state laws. That said, most states comply with the 20% regulation.

Instead, you just require 20% of the bid. Nevertheless, if the residential or commercial property does not redeem at the end of the redemption duration, you'll need the staying 80% to acquire the tax obligation act. Since you pay 20% of your proposal, you can earn interest on an overage without paying the complete price.

Once more, if it's lawful in your state and county, you can work with them to help them recoup overage funds for an extra cost. You can gather rate of interest on an overage proposal and charge a charge to enhance the overage insurance claim process for the previous proprietor. Tax obligation Sale Resources lately launched a tax sale excess product specifically for individuals curious about pursuing the overage collection service. delinquent tax sale list.

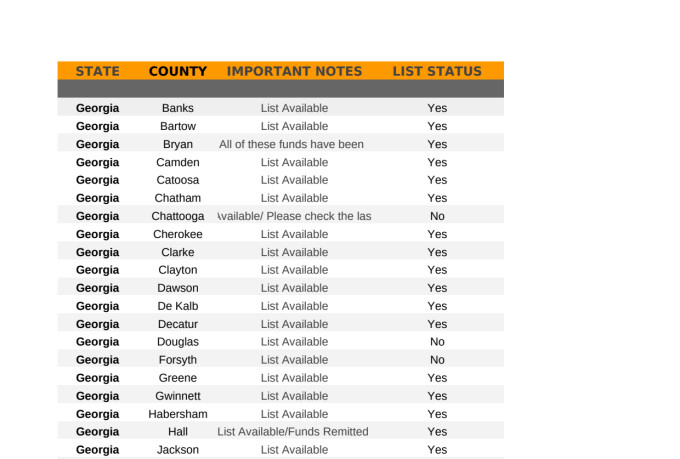

Overage collectors can filter by state, region, building kind, minimal overage quantity, and optimum excess quantity. Once the information has actually been filteringed system the collection agencies can decide if they want to add the miss mapped data bundle to their leads, and afterwards pay for only the confirmed leads that were located.

Tax Overage Business

In enhancement, simply like any kind of other investment method, it provides special pros and disadvantages.

Tax obligation sale overages can form the basis of your financial investment version due to the fact that they supply an inexpensive way to gain cash (houses lien for sale). You do not have to bid on homes at auction to invest in tax sale overages.

Rather, your research, which might include avoid tracing, would cost a comparatively small charge.

Your sources and technique will identify the very best atmosphere for tax overage investing. That stated, one strategy to take is gathering interest over premiums. Therefore, financiers can acquire tax obligation sale excess in Florida, Georgia - unclaimed surplus funds list, and Texas to benefit from the premium bid legislations in those states.

Any kind of public auction or repossession involving excess funds is a financial investment possibility. You can invest hours looking into the previous proprietor of a home with excess funds and call them only to find that they aren't interested in pursuing the money.

Latest Posts

Tax Liens New York

Investing In Tax Liens Risks

Do I Have To Pay Taxes On My Foreclosed Home